I fell into this sort of thing by accident, out of panic that the pandemic was going to sink the economy, my savings, and more. I decided I needed to at least try to fight back. I was successful, so now I want to share what I've learned to you.

When the coronavirus hit in early March, I saw my existing

RRSP savings account drop by over 25%, which sent some real panic down my spine

and sprung me into action to see if there was anything I could do about it. After

meeting with my bank, there really wasn’t. they basically put me at ease and

told me it should bounce back, which is still hasn’t quite, but is getting

there.

I examined my RRSP portfolio and took notice of what

segments were down the most, and then started researching ways that I could

seize an opportunity out of this massive panic drop. That’s what I want to

share with you, because so far I’ve been successful in doing so.

I decided to open up a trading account within my TFSA (tax

free savings account). A TFSA limit in Canada is now up to $66000 you can

deposit and the government cannot touch it with their grubby tax hands. Now, I don’t

have $66000, but I had a little bit saved up not working for me that I decided

to start down this route, and I’m here to encourage you to do the same.

Find a platform to start a self directed trading account

within your TFSA using a bank or private trading firm like Questrade, TD

waterhouse, BMO investorline etc.

Trades typically cost anywhere from $5 to $10 each so its manageable

if you have a few hundred or thousand dollars to invest in something.

The next step is to find industries or business models that

are sound, but are in a decline due to the ongoing pandemic OR that are just

starting to blossom due to the pandemic. In this post im only going to talk

about TSX (Toronto stock exchange) because that’s all I dabbled in.

In March, I found the industry that was in the dumps the

most was the energy industry. Almost overnight, multi-billion dollar oil and

gas companies like Cenovus, Husky, Suncor, Vermillion etc. all took a hit to

the tune of about 70%. The energy giants are closely followed behind the

smaller energy companies like Peyto, Painted Pony, Baytex, Gran Tiera.

The first thought I had was “is this a sinking ship?” which I knew it was not. We still use gasoline and drill oil throughout Canada, and pipelines for energy export and still going to take place while the country tries for an economic recovery.

I decided the low-end energy sector was a sound place to

invest of 35% of my portfolio. The stocks are still not even half way back to

where they were, but forecasts on future global demands indicate that they will

eventually rise up to higher levels than they were pre-covid, so there's still

time to get in while the getting is good. Plus, despite protests and objections, pipelines will still get built. The Canadian energy sector is one of the most environmentally conscious in the world, so its in good hands to be succesful. I bought many of them in March and

experienced an over 100% increase in value by May, so I doubled my money in

some cases.

Here’s some of the stocks I bought into in march that are

winners so far for me.

Peyto Exploration and Development Corp (TSX:PEY): bought in

march for $1.56 per share, now worth $3.08 as I write this, and has had an all

time high of $42 per share.

Cenovus Energy Inc (TSX:CVE): bought in may at $4.08, now

worth $6.35 as I write this, and has a pre-Covid fluctuation of about $14-$15

dollars per, so theres still room to grow.

Baytex Energy (TSX:BTE): bought in April at $.29 per share,

now worth $.68 and rising consistently

Painted Pony Energy (TSX:PONY): bought in march at $.28 per

share, now worth $.68

Crescent Point Energy (TSX:CPG): bought in june at $.2.04,

now worth $2.40

Next segment of my investment was into the bank stocks. These

ones tend to trade around the higher cost per share, but they are also the ones

you hang onto for long periods of time. We call these “blue chip” stocks

because they make you money just by having them by providing you with a healthy

dividend. A dividend is the kickback that a stock gives you for investing into

them, a sort of profit sharing program. Banks in Canada are historically resilient,

and offer usually about a 4-6% dividend per share compounded quarterly. Which means,

if you own $100000 in bank stocks, you’re going to get $4-6000 per year just

for having it. That’s an interest rate we can all get behind. Canadian Banks

took a large hit when corona hit but are on the steady incline back to normal. They

may fluctuate a bit and you may go up and down like a new bride’s pajamas for a

while, but they are fairly safe bets for a long term holding. Think of it this way

– if a bank stock collapses, that means everyone that has their money is that bank,

their mortgage with that bank is completely fucked. If that does happens, you’ll

see blood in the streets so it’s a good bet to invest with a bank.

The higher cost blue chip banks are TD, RBC, BMO. The ones

that cost a bit less are Canadian Western Bank (CWB) and Bank of Nova Scotia

(BNS). These stocks still have about a 20-30% rise potential to get back to

where they were pre covid, but they most likely will, so get in while you can,

and start enjoying the dividend to reinvest as you see fit.

I made my portfolio about 45% bank stocks because that way if everything else is a loser, I'll at least be able to claw black with my blue chips eventually.

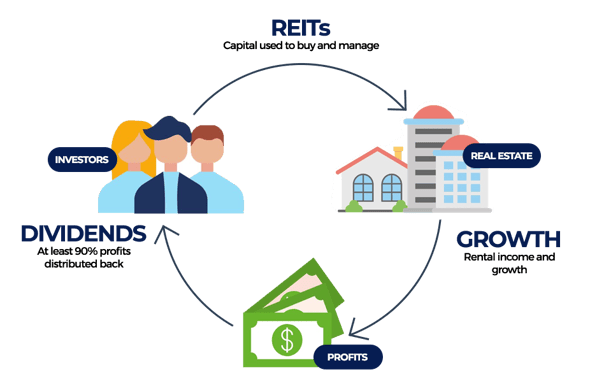

Thirdly, I invested about 10% into REIT markets, which stand

for Real Estate Investment Trust. These are large companies that typically

invest in owning large scale income producing real estate like office buildings,

apartments, dorms, care homes etc. COVID has shown some of these to be losers

because now more than ever we are working from home so office buildings have

lost some of their value. The REITs that invested all their eggs in the office

building basket, are down and I cant see them coming back anytime soon, because

first they need to reinvest into residential, retail or warehouse space to bring

the demand back and regain a steady revenue stream (balance sheet)

REITS also typically offer a dividend to shareholders, some

even monthly, as sort of a rent payment for allowing them to have so many

dollars to invest further. The one I bought into was called H&R

investments, which is now up %11 from when I bought it in June, but you can

take your pick of the litter if you’re willing to do research on one of their business

models you think sounds like it’ll work.

And finally, with the last part of my portfolio around %15,

choose things that have prospered from Covid. Industries that have formed from

there being a pandemic, and that will emerge as it fades away. These are things

like online retailers (which are usually way too expensive to invest in),

pharmaceuticals which may have contracts to search for a vaccine, research and

development firms, and healthcare stocks. You can do your research on these and

take your pick on which one seems to peak your interest.

The stock I chose for this is called Well Health

Technologies TSX:WELL. This company is one of the leading startup technology companies

that helps you make an online doctors appointment via video conference, and

store medical data in a web based secure cloud software. This one could be the

next big one as articles I've read on it suggest you could turn $1000 into $35000

within a few years. I bought it 2 weeks ago at $3.25 per share and its already

at $4.92 per share with limited downward turns during market hours.

Obviously, with stocks there are always risks and if I was

writing this in February and giving all my recommendations and you followed

suit, you’d be way down now because there was a pandemic. BUT, overall the

markets haven’t even clawed half way back to where they were, which they

presumably eventually will as history has shown us. So this may be a good time

to start a trading account of your own, take your investment destiny into your

own hands by treating it like a sort of game. Research companies like you creep

Instagram, and before you know it you’ll have some idea about market climate. Try

to predict dips and sell before they happen. Then re-buy once they’ve fallen

and enjoy the profits from watching them rise back up.

If the pandemic has hit you hard in your bank investments then

you’ve probably come to the realization that the bank doesn’t give a shit about

the company RRSP you’ve got set up or the mutual fund hit that your few thousand

dollar investment has taken, so why not take the bull by the horns and do what

you can to turn your 1, 5, 10 or however many thousand dollars you can into

something much, much bigger.

I didn’t have much to invest in the first place, because I’m

not a wealthy man, but what I was able to invest has increased an overall 50%

by being involved and doing the research myself, my goal is to keep this up and repeat until I get old because no matter what is going on in the world, there is always money to be made. There is always money in the Banana Stand.

These are uncertain times, and a lot of people are struggling to make ends meet. I get that, I sympathize with that and I don’t want that to happen to me. The best chance I have of that is to try and think like I’m Warren Buffett on a microscopic scale. History has shown us that in situations like this usually the rich get richer and the poor get poorer, so why don’t us poor folks start faking it till we make it?

I only wrote this to try and help you succeed and to

possibly spark in interest in you to learn the market yourself, learn how it

works and then try and see if you can make it work for you.

If I have peaked your interest and you’d like to discuss

further, please message me, I'd love to hear how you’ve succeeded or try and

help you get on the path to do so!

Here’s to a prosperous future for you and yours!

Stay safe out there,

Jegger